Taxation

California’s tax policies must be fair and foster investment in the manufacturing sector. Tax credits and deductions are vital to creating additional employment, expansion of the manufacturing base, and increasing California’s economic opportunity.

PG&E and Acena Consulting Join CMTA as Associate Members

Sacramento, Calif. – The California Manufacturers & Technology Association (CMTA) is proud to welcome two new associate members, Pacific Gas and Electric Company (PG&E) and Acena Consulting to the association. Both companies bring significant expertise that...

CMTA’S President & CEO Releases Statement on Passage of AB 98 (J. Carrillo)

Sacramento, Calif. – California Manufacturers & Technology Association (CMTA) President and CEO, Lance Hastings, released the following statement on the passage of Assembly Bill 98 (J. Carrillo), the statewide mandate on warehouse operations. “On Sunday evening,...

CMTA’s CEO & President Releases Statement on Gov. Gavin Newsom Vetoing Manufacturing Tax Credit, AB 52 (Grayson)

Sacramento, Calif. – Late Friday evening, California Governor Gavin Newsom returned AB 52 (Grayson) to the Legislature without his signature. This bill would have provided an investment tax credit for the purchase of manufacturing equipment. In his veto message,...

How AB 52, Manufacturing Tax Credit, Will Expand California Jobs

California manufacturing generates more than $394 billion annually and employs more than 1.3 million people with over 30,000 firms. Our manufacturers are the most significant contributor to the United States manufacturing industry, making up 11% of the manufacturing...

CMTA Government Relations Update: California Assembly Bill Would Create Tax Credit for Manufacturers

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector. https://youtu.be/F8B9bRRI5s8 This proposed legislation, which aims to introduce a manufacturing tax credit for qualified manufacturing...

CMTA Government Relations Update: A Recently Expired California Incentive Program May be Reestablished

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector. https://www.youtube.com/watch?v=OOD_nmxABJo The California Legislative Summer Recess is approaching on July 3, 2024. This date marks the...

CMTA Government Relations Update: California’s Manufacturers May Lose a Major Training Program

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector. https://youtu.be/Dmj-DjtEur0 Both the Assembly and Senate have a huge deadline on Friday, May 24, 2024, to pass bills introduced in their...

Government Relations Update: Two Bills That Could Impact California Manufacturers

This month's Government Relations Update video delves into crucial legislative developments impacting California's manufacturing sector. California legislation's fiscal deadline is April 26th. All bills with a fiscal impact are due for consideration by the...

Government Relations Update: New Video Series on the Latest News in California’s Legislature

Ready to learn more about what is happening in California’s legislature? Check out our brand-new Government Relations Update video with CMTA’s Vice President of Communications, Ananda Rochita. 📝 Learn About California’s 2024 Intro Bills 💰 Find out what is Going to...

ISO Certifications Leading to $250k in Tax Credits

Did you know that improving manufacturing processes can qualify for the Research and Development Tax Credit? IMSM, leading ISO specialists, has partnered with Strike Tax Advisory, a firm that enables all businesses to take advantage of the R&D tax credit with no...

Press Releases

PG&E and Acena Consulting Join CMTA as Associate Members

Sacramento, Calif. – The California Manufacturers & Technology Association (CMTA) is proud to welcome two new associate members, Pacific Gas and Electric Company (PG&E) and Acena Consulting to the association. Both companies bring significant expertise that will benefit CMTA’s mission of supporting and strengthening California’s manufacturing industry.

“We are thrilled to welcome these two companies as new associate members,” said Lance Hastings, CEO & President of CMTA. “Acena Consulting’s expertise in tax strategy and PG&E’s energy solutions will provide valuable resources for our members, helping them meet challenges and drive innovation in California’s manufacturing industry.”

PG&E provides natural gas and electric services across Northern and Central California, supporting the energy needs of more than 16 million people. The utility has over 105,000 circuit miles of electric distribution lines and 42,141 miles of natural gas distribution pipelines.

“We are incredibly excited to partner with CMTA as we look to engage with and support our manufacturing and technology customers,” said Aaron Johnson, Senior Vice President at PG&E. “These companies are the foundation of California’s economic engine, and we are honored to help them thrive.”

Acena Consulting is a premier tax consultancy that specializes in areas such as the R&D Tax Credit and Cost Segregation, helping businesses maximize financial opportunities. The company is committed to supporting the manufacturing industry and contributing to the economic vitality of California through their work.

“We are excited to join CMTA and contribute to their mission of supporting and growing California’s vibrant manufacturing sector,” said Nick Pyzow, Director at Acena Consulting. “We believe our expertise will be a valuable resource for CMTA members looking to optimize their financial performance.”

By bringing PG&E’s energy solutions and Acena’s tax consulting expertise into the fold, CMTA members will have access to critical resources that will help them streamline operations, stay competitive, and push the boundaries of innovation in California’s manufacturing sector.

###

About CMTA

The California Manufacturers & Technology Association has advocated for pro-growth laws and regulations before the California legislature and administrative agencies since 1918. The total output from manufacturing in California is $300 billion per year, roughly 10 percent of the total economic output of the state. Manufacturers employ 1.3 million Californians paying wages more than $25,000 higher than other non-farm employers in the state. For more information, visit CMTA’s website.

About PG&E

Pacific Gas and Electric Company, a subsidiary of PG&E Corporation (NYSE: PCG), is a combined natural gas and electric utility serving more than sixteen million people across 70,000 square miles in Northern and Central California. For more information, visit pge.com and pge.com/news.

About Acena Consulting

Acena Consulting is a tax consultancy firm specializing in helping businesses maximize tax deductions and leverage financial opportunities. Their services include R&D Tax Credit Support and Cost Segregation. For more information, visit Acena’s website.

CMTA’S President & CEO Releases Statement on Passage of AB 98 (J. Carrillo)

Sacramento, Calif. – California Manufacturers & Technology Association (CMTA) President and CEO, Lance Hastings, released the following statement on the passage of Assembly Bill 98 (J. Carrillo), the statewide mandate on warehouse operations.

“On Sunday evening, California Governor Gavin Newsom signed AB 98, a bill regulating logistics and warehouse facility development, passed by the Legislature without consulting manufacturers. The provisions of AB 98 were revealed in the last few days of the legislative session, receiving very little review prior to passage.

Despite its aim to address environmental concerns, AB 98 imposes strict and ambiguous restrictions on facility locations, posing significant challenges to California’s 30,000 manufacturers, who often operate as temporary warehouses by moving and storing products on-site. Most business organizations opposed the bill due to its broad and detrimental impact on an already costly regulatory landscape. The rigid mandates will adversely affect industries beyond warehousing and may lead to job losses, ultimately harming the economy.

In their joint statement, the California Chamber of Commerce, California Retailers Association, California Restaurant Association, and California Apartment Association praised the bill as a sensible compromise. However, this perspective overlooks the reality that AB 98 imposes severe constraints that could stifle economic growth and innovation. The claim that it avoids negative impacts is misguided; the bill will instead exacerbate the challenges faced by our manufacturers.

The Governor has now vetoed manufacturing’s top priority (AB 52) and signed manufacturing’s biggest threat (AB 98). The California Manufacturers & Technology Association advocates for a more strategic approach to achieving the state’s environmental goals while supporting economic growth. We will propose legislation next year to minimize the impact of AB 98 on manufacturers across the state. We need leaders who backs manufacturing with more than just words—too much is at stake for California’s economy.”

###

About CMTA

The California Manufacturers & Technology Association (CMTA) has advocated for pro-growth laws and regulations before the California legislature and administrative agencies since 1918. The total output from manufacturing in California is $300 billion per year, roughly 10 percent of the total economic output of the state. Manufacturers employ 1.3 million Californians paying wages more than $25,000 higher than other non-farm employers in the state. For more information, visit CMTA’s website.

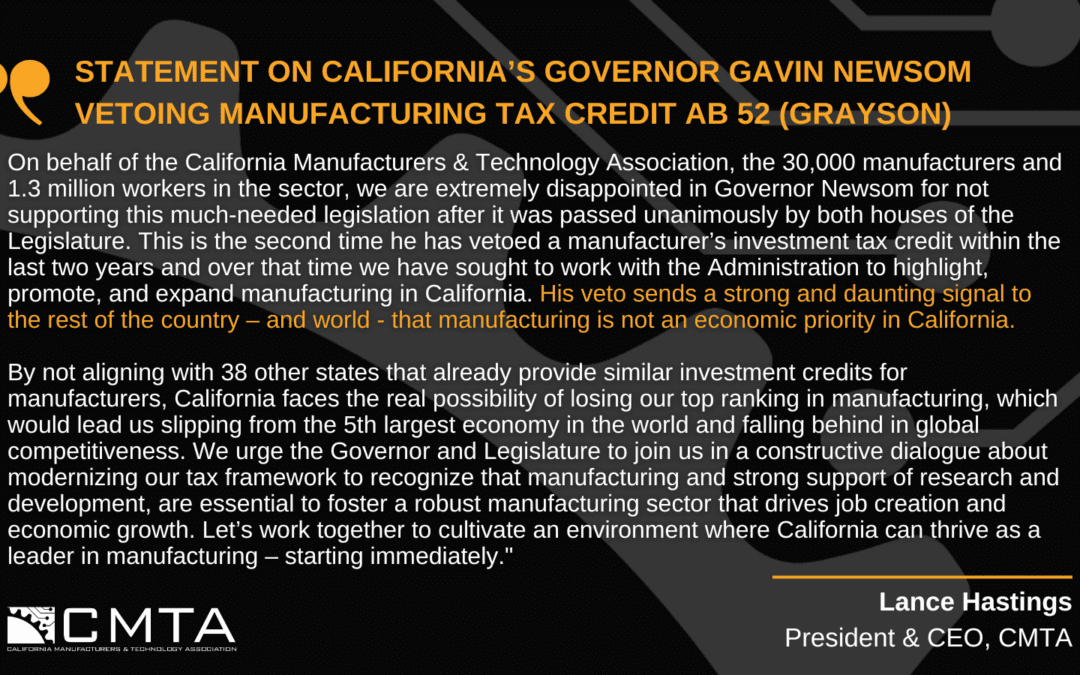

CMTA’s CEO & President Releases Statement on Gov. Gavin Newsom Vetoing Manufacturing Tax Credit, AB 52 (Grayson)

Sacramento, Calif. – Late Friday evening, California Governor Gavin Newsom returned AB 52 (Grayson) to the Legislature without his signature. This bill would have provided an investment tax credit for the purchase of manufacturing equipment.

In his veto message, Governor Newsom stated this bill would have a significant impact on the state general fund and should be considered in the annual budget process.

California Manufacturers & Technology Association CEO and President Lance Hastings released this statement in response to the veto:

“On behalf of the California Manufacturers & Technology Association, the 30,000 manufacturers and 1.3 million workers in the sector, we are extremely disappointed in Governor Newsom for not supporting this much-needed legislation after it was passed unanimously by both houses of the Legislature. This is the second time he has vetoed a manufacturer’s investment tax credit within the last two years and over that time we have sought to work with the Administration to highlight, promote, and expand manufacturing in California. His veto sends a strong and daunting signal to the rest of the country – and world – that manufacturing is not an economic priority in California.

By not aligning with 38 other states that already provide similar investment credits for manufacturers, California faces the real possibility of losing our top ranking in manufacturing, which would lead us slipping from the 5th largest economy in the world and falling behind in global competitiveness. We urge the Governor and Legislature to join us in a constructive dialogue about modernizing our tax framework to recognize that manufacturing and strong support of research and development, are essential to foster a robust manufacturing sector that drives job creation and economic growth. Let’s work together to cultivate an environment where California can thrive as a leader in manufacturing – starting immediately.”

###

About CMTA

The California Manufacturers & Technology Association (CMTA) has advocated for pro-growth laws and regulations before the California legislature and administrative agencies since 1918. The total output from manufacturing in California is $300 billion per year, roughly 10 percent of the total economic output of the state. Manufacturers employ 1.3 million Californians paying wages more than $25,000 higher than other non-farm employers in the state. For more information, visit CMTA’s website.

How AB 52, Manufacturing Tax Credit, Will Expand California Jobs

California manufacturing generates more than $394 billion annually and employs more than 1.3 million people with over 30,000 firms. Our manufacturers are the most significant contributor to the United States manufacturing industry, making up 11% of the manufacturing jobs in the nation and accounting for 14.5% of the national manufacturing GDP.

California can strengthen its leadership in innovation and manufacturing by investing in a manufacturing tax credit.

AB 52 (Grayson) transforms the current incentive landscape, making manufacturing investment in California far more competitive and bringing us in line with 38 other states that already cover the taxes on qualified manufacturing purchases.

Let’s end the trend of “Invent Here, Build There.”

Watch more about how AB 52 will benefit California’s manufacturing workforce here.

CMTA Government Relations Update: California Assembly Bill Would Create Tax Credit for Manufacturers

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector.

This proposed legislation, which aims to introduce a manufacturing tax credit for qualified manufacturing equipment and research and development (R&D) purchases, has recently cleared a critical hurdle, passing the Senate and Assembly Floors with unanimous support. It now moves to Governor Gavin Newsom’s desk for a final signature.

California is the nation’s leading state in manufacturing, boasting over 30,000 manufacturers who collectively employ more than 1.3 million people. However, the current economic conditions have not been favorable to the state’s manufacturers, particularly small to medium-sized ones. These businesses, which make up more than 70% of California’s manufacturing landscape, have faced increasing challenges due to the state’s high tax rates at the state and local levels.

AB 52 represents a potential game-changer for these manufacturers. If signed into law by Gov. Newsom, this bill will provide much-needed financial relief to manufacturers by offering tax credits for crucial investments in manufacturing equipment and R&D. This could significantly reduce operational costs, making it a more attractive option for businesses to remain and expand their operations within the Golden State.

AB 52 is projected to have a broader impact on California’s economy. The bill is expected to create approximately 163,000 new manufacturing jobs and generate up to $3.5 billion in new economic activity. The potential growth will benefit the manufacturing sector and contribute to the state’s overall economic vitality.

Moreover, AB 52 aligns with California’s environmental goals. By making it more affordable for manufacturers to invest in carbon-neutralizing products and equipment, the bill supports the state’s efforts to reduce its carbon footprint. AB 52 has the potential to help the state meet both its economic and environmental objectives, fostering a more sustainable industrial ecosystem.

One of the most promising aspects of AB 52 is its potential to reverse the trend of “Invent Here, Build There,” a situation where innovations developed in California are manufactured elsewhere due to cost concerns. By reducing these financial burdens, the bill encourages manufacturers to keep their operations within the state, allowing them to excel and contribute to California’s long-standing tradition of innovation.

Do you want to get exclusive government relations insights from CMTA? 📲 Reach out to members@cmta.net.

CMTA Government Relations Update: A Recently Expired California Incentive Program May be Reestablished

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector.

The California Legislative Summer Recess is approaching on July 3, 2024. This date marks the deadline for policy committees to meet and report bills, after which the State Legislature will take a break and reconvene on August 5, 2024.

AB 2922 (Garcia), a CMTA Maker Bill, is aimed at revitalizing the recently expired Capital Investment Incentive Program. If successful, this bill will extend the program until January 1, 2035, providing financial incentives to attract qualified manufacturers to California. AB 2922 promotes economic growth, job creation, and regional development by allowing counties and cities to offer tax benefits to manufacturers with significant capital investments. This bill has been referred to the Senate Local Government Committee and represents a substantial opportunity for the state’s manufacturing sector to continue to thrive.

Learn more about CMTA’s bills here.

Do you want to get exclusive government relations insights from CMTA? 📲 Reach out to members@cmta.net.

CMTA Government Relations Update: California’s Manufacturers May Lose a Major Training Program

This month’s Government Relations Update video highlights crucial legislative developments for California’s manufacturing sector.

Both the Assembly and Senate have a huge deadline on Friday, May 24, 2024, to pass bills introduced in their house of origin. In the days leading up to this deadline, both houses are intensively reviewing and voting on various bills. This legislative activity is critical for manufacturers to monitor, as the outcomes will shape the regulatory and operational landscape for the sector.

A significant point of concern for California’s manufacturing industry is Senate Bill 1321, spearheaded by Senator Aisha Wahab. This bill proposes an overhaul of the Employment Training Panel (ETP), which has been instrumental in providing workforce development funding. The ETP has allocated over $26.7 million, benefiting more than 37,000 employees in the manufacturing sector. However, the proposed changes threaten to dismantle this vital program, jeopardizing sustainable jobs and career pathways. The California Manufacturers & Technology Association (CMTA) identifies this bill as a Manufacturing Breaker Bill as it is a potential disruptor to the stability and growth of the industry.

Another concerning bill for California’s manufacturers is Assembly Bill 2083, led by Assemblymember Marc Berman, which mandates the California Energy Commission to assess the feasibility of reducing greenhouse gas emissions from industrial heat applications by 85% below 1990 levels by 2045. While the bill aims for significant environmental advancements, its current form is flawed due to its narrow focus on zero-emission and electrified equipment, excluding more cost-effective and technologically viable alternatives like hydrogen fuel and carbon capture. AB 2083 is an attempt to force the California industry away from natural gas in a manner that is not cost-effective or technologically possible at this time. Cost is even more concerning given that the legislature is considering eliminating R&D tax credits and minimizing the Net operating losses for businesses as part of the budget due to California’s most recent updated budget announcement. CMTA identifies AB 2083 as a Manufacturing Breaker Bill.

Do you want to get exclusive government relations insights from CMTA? 📲 Reach out to members@cmta.net.

Government Relations Update: Two Bills That Could Impact California Manufacturers

This month’s Government Relations Update video delves into crucial legislative developments impacting California’s manufacturing sector.

California legislation’s fiscal deadline is April 26th. All bills with a fiscal impact are due for consideration by the Appropriations Committees, signaling a critical phase for proposed policies.

Assemblymember Luiz Rivas’s AB 2400 takes center stage, proposing an extension of the California Alternative Energy and Advanced Transportation Financing Authority Act (CAEATFA). This act, fostering partnerships to offer financing solutions, aims to slash greenhouse gas emissions and energize economic growth. Since the act’s establishment in 2010, the sales and use tax exclusion incentive program within CAEATFA for manufacturers of green technologies identifies a nexus between California’s economic and environmental goals. Since its inception, over 128,000 jobs have been created or retained, spurring investment that totals over $2.5 billion in fiscal benefits and $415 million in environmental benefits. AB 2400, a CMTA maker bill, stands to profoundly benefit California’s manufacturers.

Assemblymember Diane Papan’s AB 2515 raises pivotal concerns for menstrual product manufacturers in California. The bill seeks to prohibit the sale of products containing any detectable PFAS, potentially exposing manufacturers to extensive liabilities and punitive penalties. While CMTA’s members are not intentionally adding PFAS chemicals to these products, the bill contains a private right of action and the ability to levy punitive financial penalties on manufacturers. Companies should not intentionally add these chemicals, but the legislation needs additional considerations before CMTA removes its opposition.

Stay informed with the latest updates from the Government Relations Update video series, offering invaluable insights for manufacturers navigating California’s legislative environment.

Do you want to get exclusive government relations insights from CMTA?

📲 Reach out to members@cmta.net.

Government Relations Update: New Video Series on the Latest News in California’s Legislature

Ready to learn more about what is happening in California’s legislature? Check out our brand-new Government Relations Update video with CMTA’s Vice President of Communications, Ananda Rochita.

📝 Learn About California’s 2024 Intro Bills

💰 Find out what is Going to Happen with California’s Projected Budget.

⚙️ CMTA’s Sponsored Bills Are Coming Your Way Soon…

Do you want to get exclusive government relations insights from CMTA?

📲 Reach out to members@cmta.net.

ISO Certifications Leading to $250k in Tax Credits

Did you know that improving manufacturing processes can qualify for the Research and Development Tax Credit?

IMSM, leading ISO specialists, has partnered with Strike Tax Advisory, a firm that enables all businesses to take advantage of the R&D tax credit with no out-of-pocket costs to ensure manufacturers realize both the obvious and not-so-obvious benefits of continuous improvement. A webinar detailing how manufacturers qualify, what expenses qualify, and walking through a case study of a manufacturing client will be hosted on January 24, 2024, at 11 am PST. Join the webinar here.

The manufacturing industry is one of the most qualified industries for the R&D tax credit. Manufacturing organizations that do process/product improvement or development are arguably the most qualified types of entities for this tax credit. Examples of qualifying activities include:

- Designing and developing alternative processes

- Processes to enhance throughput

- Prototype development and testing

- Evaluating new materials to impart improved functionality or performance

- Creating novel equipment

- Developing environmentally friendly products/processes

- Developing new products

- Implementing lean manufacturing processes

- Computer-aided design (CAD) and 3D modeling

The R&D tax credit is a permanent U.S. federal and state tax credit used to encourage U.S. businesses to keep highly technical jobs within the U.S. and promote further innovation. The R&D tax credit provides dollar-for-dollar tax savings to businesses of any size, these credits are used to offset income tax liabilities OR quarterly payroll tax if not yet in a profitable position.

The average amount of total expenses that qualify in the manufacturing industry is 28%! Don’t believe this? Use this R&D calculator to get a rough idea of what your business can qualify for going back to 2020. The tax credit is eligible to all manufacturing organizations, ISO is not a requirement. However if your organization is ISO 17025 Lab Competency, ISO 170202 Conformity Assessment, ISO 13485 Medical Device, ISO 9001 Quality Management certified, you hold a high probability of qualifying.

So, why pay the IRS when the IRS can pay you? Let an IRS-qualified tax credit expert explore the possibility of YOUR business tax credit by scheduling an appointment. Call Tina Travierso at (858) 761-7738 or email for an appointment at tinatravierso@imsm.com.

International Management Systems Marketing (IMSM) is the leading ISO specialist with a goal to deliver world-class ISO consultations for organizations of all sizes, from all sectors, all over the world. IMSM is known as, a turnkey fail-safe consulting organization that supports a lean environment by drafting 75% of the operational manual and guaranteeing a pass on your International Standardized Operations (ISO) Certificate., Benefits of the various ISO include less returned merchandise, fewer defective products, lower workers and medical health insurance premiums, reduced OSHA fines, proof of corporate sustainability, and more RFP’s are won with ISO Certification as a result

##

About CMTA:

The California Manufacturers & Technology Association has advocated for pro-growth laws and regulations before the California legislature and administrative agencies since 1918. The total output from manufacturing in California is $300 billion per year, roughly 10 percent of the total economic output of the state. Manufacturers employ 1.3 million Californians, paying wages more than $25,000 higher than other non-farm employers in the state. For more information, visit the CMTA website.

About IMSM:

IMSM (International Management Systems Marketing) are leading ISO specialists. We deliver high-quality ISO consultancy services and standards to organizations of all sizes, from all sectors, all over the world. As an organization, we work towards a common goal: to consistently deliver to our clients world-class ISO consultation, reinforced by adherence to our IMSM Mission, Vision, and Values. For more information, visit IMSM’s website.